1 yr. ago

have just join this platefourm, let see what they have and how we can go ahead.

1 yr. ago

I want to invest in indian stock market which can double my money in next 3 months which are the stocks to consider in defense sector , infra , consumer durables , ems , transformers , fmcg, railways etc Pl suggest

3

people voted

1 yr. ago

Subscribe to Unlock

For $5 / Monthly

1 yr. ago

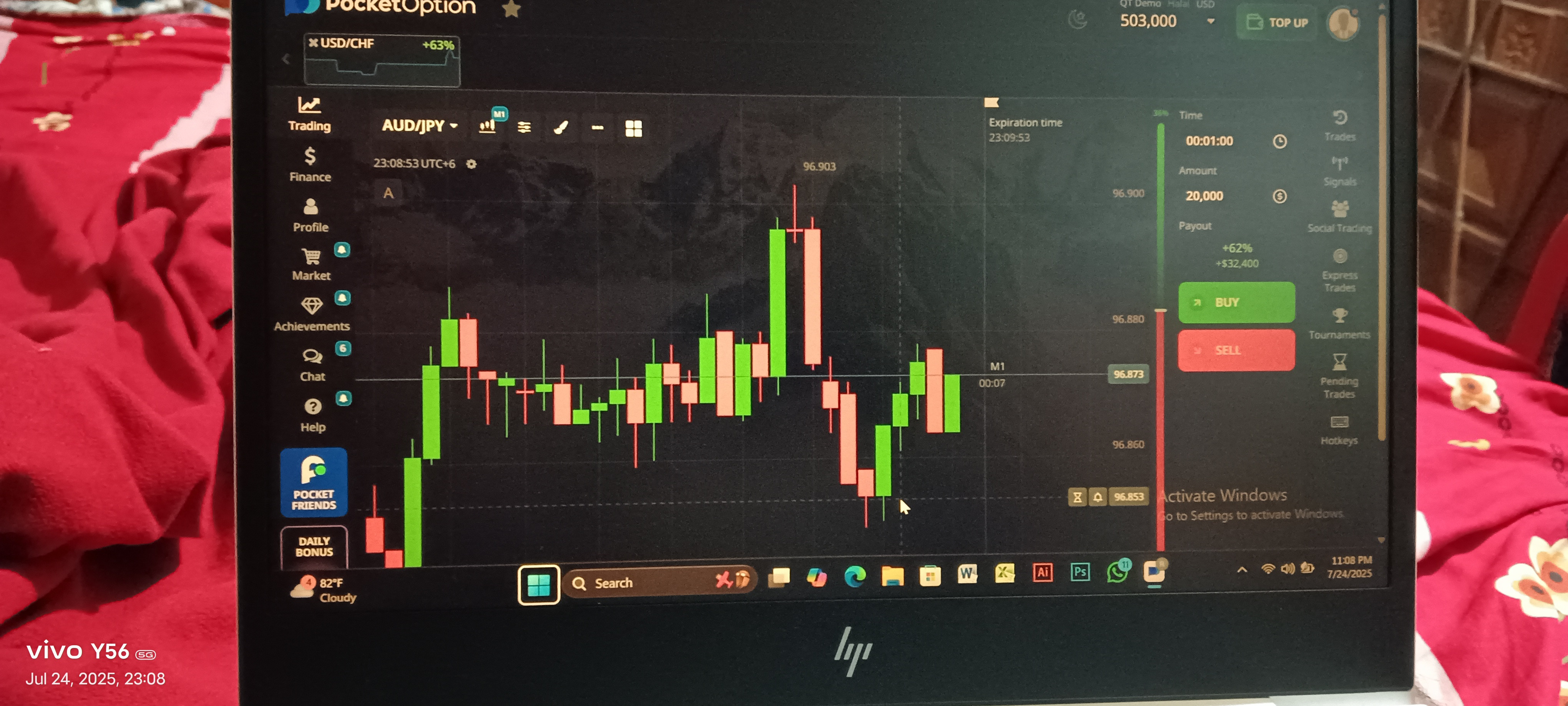

El franco suizo es tradicionalmente considerado un refugio seguro. Si la guerra en Ucrania se intensifica o si surgen nuevas crisis geopolíticas, la demanda de CHF como activo de refugio podría aumentar, independientemente de la ayuda económica a Ucrania.

no se porque no estamos viendo al franco en niveles minimos de pandemia , pero va en camino #trading #trader #usdchf $usdchf $chf

no se porque no estamos viendo al franco en niveles minimos de pandemia , pero va en camino #trading #trader #usdchf $usdchf $chf

Subscribe to Unlock

For $5 / Monthly

2 yr. ago

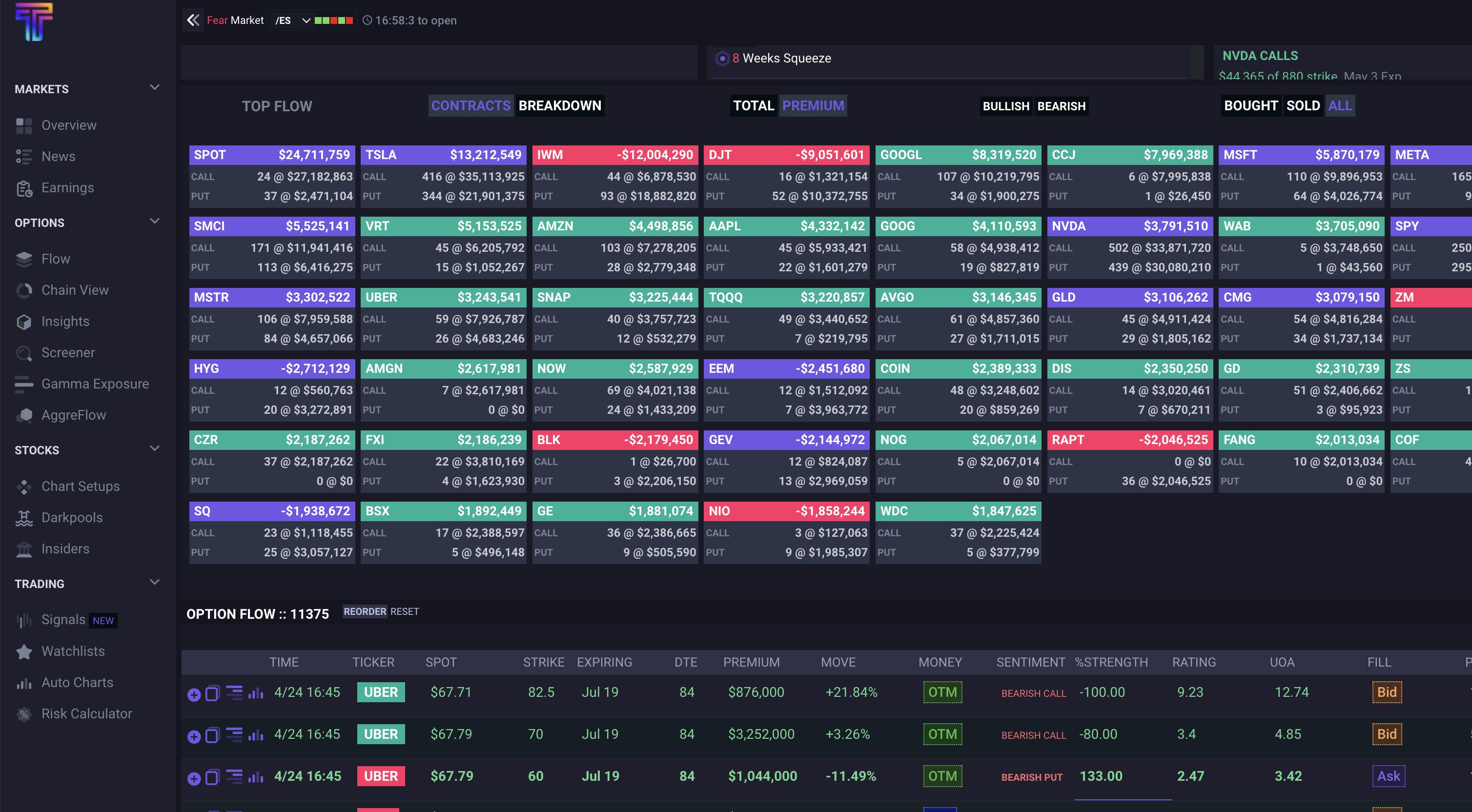

TradeUI - State Street Technology ETF To Put Nvidia Before Apple In Revamp

Tech ETF to boost Nvidia exposure at Apple's expense, triggering billions in trading volume. Rebalance to reflect Nvidia's market value surpassing Apple's.

https://tradeui.com/news/39368302/state-street-technology-etf-to-put-nvidia-before-apple-in-revamp

2 yr. ago

TradeUI - NVIDIA Option Alert: Jun 14 $1035 Calls at the Ask: 68 @ $176.8 vs 188 OI; Ref=$1208.025

Sure, here is the keyword rich description: **NVIDIA Option Alert: June 14 $1035 Calls at the Ask: 68 @ $176.8 vs 188 OI; Ref=$1208.025 and premium paid is $1202240.0**

https://tradeui.com/news/t-2422/nvidia-option-alert-jun-14-1035-calls-at-the-ask-68-1768-vs-188-oi-ref1208025

2 yr. ago

Gold is currently trading at $2,315, reflecting a decline of 0.17% in today’s session. The precious metal is maintaining its position above the key pivot point of $2,310.75, having completed a 23.6% Fibonacci retracement around this level. This suggests the potential for a bullish reversal.

Immediate resistance is identified at $2,310.75, with further resistance levels at $2,325.55, $2,337.19, and $2,348.85. On the downside, immediate support is found at $2,287.07, followed by $2,273.43 and $2,260.22.

Technical indicators provide additional context. The 50-day Exponential Moving Average (EMA) stands at $2,329.96, and the 200-day EMA is at $2,334.25. Both indicators suggest a slight bearish trend, given that the current price is below these averages. However, holding above the pivot point of $2,310.75 may indicate a short-term bullish outlook.

Immediate resistance is identified at $2,310.75, with further resistance levels at $2,325.55, $2,337.19, and $2,348.85. On the downside, immediate support is found at $2,287.07, followed by $2,273.43 and $2,260.22.

Technical indicators provide additional context. The 50-day Exponential Moving Average (EMA) stands at $2,329.96, and the 200-day EMA is at $2,334.25. Both indicators suggest a slight bearish trend, given that the current price is below these averages. However, holding above the pivot point of $2,310.75 may indicate a short-term bullish outlook.

2 yr. ago

2 yr. ago

'Google Acquires Virtual App Delivery Platform Cameyo' - SiliconAngle; No Financial Terms Disclosed $GOOG , $GOOGL https://tradeui.com/news/3...

TradeUI - 'Google Acquires Virtual App Delivery Platform Cameyo' - SiliconAngle; No Financial Terms Disclosed

TradeUI is the best platform to watch your favorites stocks and stay in touch with all its related news , signals and more

https://tradeui.com/news/39189028/google-acquires-virtual-app-delivery-platform-cameyo-siliconangle-no-financial-terms-disclosed

2 yr. ago

New York Governor Indefinitely Delays Start Of Congestion Pricing In Manhattan $SPY https://tradeui.com/news/3...

2 yr. ago

Happy Memorial Day, traders! As we commemorate the brave souls who served, let's also cherish the liberty we have. 🇺🇸 🚀 Enjoy this special day, and here's to a future filled with profitable trades and endless opportunities! #memorialday $SPY

2 yr. ago

Will Q1 Earnings Drive Uber Stock Out Of Its Current Stagnant Trend? $UBER https://tradeui.com/news/3...

2 yr. ago

$AAPL Apple events tend to historically dump after hype and reality are a let-down, so could be a good scalp play for bearish tomorrow. Event is at 10AM est. Some bullish spread levels seem to want $185 so if we're at around that level by the time of its event I will be considering puts.

2 yr. ago

$DIS Nice bearish setup on 1y1d. Big rally right BEFORE earnings? Seems suspicious to me. Same weeks and next week options virtually same cost due to low volatility sooo, should be good to play either. No point in taking the extra decay risk when the prem prices are only about $20 to $30 more per contract. Thinking we see a retest of 110.

2 yr. ago

2 yr. ago

***** o Everyone. I'm new to trading, and have started paper trading on Think or Swim. Now I'm in the trial stage of TraderUI. Looks good so far hopefully it help me succeed in trading options.

2 yr. ago

earnings to watch for $FSR +/-37%, $SOUN +/-34.8%, $DNA +/-22.6%, $NVTS +/-20.6%, RILY +/-19.4%, ESTC +/-15.7%, ARLO +/-14.8%, SG +/-12.9%, MTZ +/-11.2%, PTCT +/-10.8%, ZS +/-10.3%, PX +/-10.2%, CERT +/-9.5%, VYX +/-8.1%, NTAP +/-7.5%, HPE +/-7.4%, VEEV +/-7.3%, GRBK +/-7.2%, QTRX +/-6.8%, ADSK +/-6.7%, TDW +/-6.2%, VRRM +/-6.1%, KWR +/-5.5%, COO +/-4.2%, CUBE +/-3.2% #earningstonight