Options flow is a robust tool that provides traders with key insights into the options market and what big money is buying/selling. The idea is to see where the “smart money” is positioned, so traders can learn to decode the information like the size of the order, type, average volume, and figure out patterns that turn out into profitable trades.

In this guide, we are going to compare the three best options order flow tools TradeUI , FlowAlgo, and CheddarFlow

Summary

TradeUI , FlowAlgo, and CheddarFlow are the leading algorithmic platforms that give you key market analysis and find the hidden order opportunities that only financial institutions have. We used each tool, and our review is based on platform functionality, pricing, accessibility, and interface.

1. TradeUI

Key highlights

TradeUI uses an algorithm to give you real-time data analysis. The platform provides access to stocks, ETF, and options trading. This tool calculates and analyzes the overall market to give multiple trading opportunities that usually large institutions have access to.

The market can sway away some time, so TradeUI evaluates various patterns and gives traders a clear breakdown of the market to enter or exit the trade at the right time.

Strengths

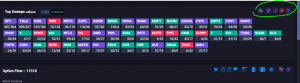

There is no doubt that TradeUI is a formidable tool for market evaluations. When you sign up, it provides the user with the dashboard and equips users with options flow. There you can monitor overall market sentiment, rating, call flow, put flow.

One of the best options is top sweepers, where the platform has a different color scheme to indicate bullish, bearish, or mixed sentiment. Also, there is a list of unusual flow that alerts infrequent bearish or bullish moves.

In addition TradeUI lines up the technical chart to the option flow, offers a wide array of features that are not available on any competing sites

Weaknesses

Although TradeUI has plenty of features released weekly, it is still on ongoing development. The pricing model of the TradeUI is divided into a Trader and Pro Plan. The basic plan or the “Trader Plan” costs $85 per month and has limited options than “Pro Plan,” which has a monthly price tag of $125. However, the pro plan has not launched yet.

Pricing

- Trial: $2/day

- Trader Plan: $67/month (annual pricing)

- Pro Plan: $125/month (annual pricing)

Overall score

- 4.5/5

2. FlowAlgo

Key highlights

If you want to spot options activity and access information that only institutions have, FlowAlgo is strong competition. The platform is algorithmically built to monitor all the essential details that you require to track sweep orders. These sweepers move quickly, staying away from the normal traders.

Strengths

Definitely the user interface! Apart from Sweepers, the dashboard panel looks intuitive, presenting the overall sentiment and the trading volume. One of the best features is that FlowAlgo lets you spot dark pools.

Darkpools are the private exchanges that are hidden from retail traders and algorithmic setups. They are known as “Darkpool prints.” They act as the support and resistance levels and help in measuring the overall market direction.

Weaknesses

Surely, functionality like this comes at a high cost. The monthly plan starts at $149. Besides this, the platform lacks the option of closing orders. These orders help you gauge sweep orders on the exit. FlowAlgo also lacks a mobile platform.

Pricing

- Trial: $37 (14 days)

- Monthly: $149

- Quarterly: $387

- Yearly: $1188

Overall score

- 4.1/5

3. CheddarFlow

Key highlights

CheddarFlow is another intuitive platform that helps you keep track of what matters. This algo-based system lets you identify order flows and rare market orders. The dashboard panel kind of looks similar to TradeUI with an option for market sentiment, trading volume, and put/call monitor.

CheddarFlow has a different color scheme for finding every possible scenario that provides trades with hidden openings.

Strengths

CheddarFlow uses AI for its indicator. This marks key trading opportunities by looking at previous datasets. When comparing it with the above-mentioned platforms, there is plenty of educational material available on the CheddarFlow website. Like FlowAlgo, the platform identifies darkpool prints.

Weaknesses

CheddarFlow doesn’t have a mobile platform, mostly focuses on sweeps and can be pricey for some people.

Pricing

- Trail: Free 7 days

- Standard plan: $85

- Premium plan: $99

Overall score

- 4.0/5

Our recommendation

All the aforementioned platforms help you find those hidden spots that are only available to large financial institutions.

If we were to select the best among them, we would pick TradeUI. It’s curated algo and advanced filters provide all the necessary details for analyzing and accessing various market opportunities. Unlike FlowAlgo and CheddarFlow, TradeUI gives a clear real time picture of the flow below the bid,bid, mid, ask and above ask orders which help you identify reversals and new trends. TradeUI also offers a wide array of tools that help line up the trend with the sweep orders.

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!