Option Flow Introduction and Strategies

How to Take Advantage of Live Options Flow Effectively

Live options flow has become quite popular in the past few years because it allows retail traders to get the pulse of the market and stay ahead of the curb. It’s a powerful tool and today we want to teach you how to take advantage of live options flow and use it effectively to find the best trading setups.

With the trade of millions of options on a daily basis, it can be difficult to find worthwhile setups. As such, it’s important to understand the technicalities of using live options flow to find the golden eggs.

An Introduction to Live Options Flow

The main reason more and more retail traders are waking up to options flow data is that this is a very powerful tool and it’s mostly underused. Very few people know how to access the tool or how to use it in trading, so that’s what we’ll help with today.

Options flow data is the term given to options data, which is also known as order flow, options order sentiment, option sweeps, or unusual options activity, which can range from a few hundred thousand to millions of dollars. These categories are all liked to big fish in the stock market, meaning market makers, prop firms, or institutional traders.

As you may already know, stock volume matters a lot when you are performing technical analysis to evaluate what direction a stock may take. However, volume can be tricky, noisy, or nonexistent.

Once you have access to information regarding what the market makers and institutional traders are doing with their options, you can use that data to your advantage. Using options flow data is based on the belief that the big fish know something that the rest of us ignore. They are definitely not guessing and risking their money.

It’s also based on the belief that a higher volume means higher prices once the flow starts coming in. This is the opposite of trading based on supply and demand or technical analysis. However, live options flow can show you when something big is on its way, which can be very beneficial.

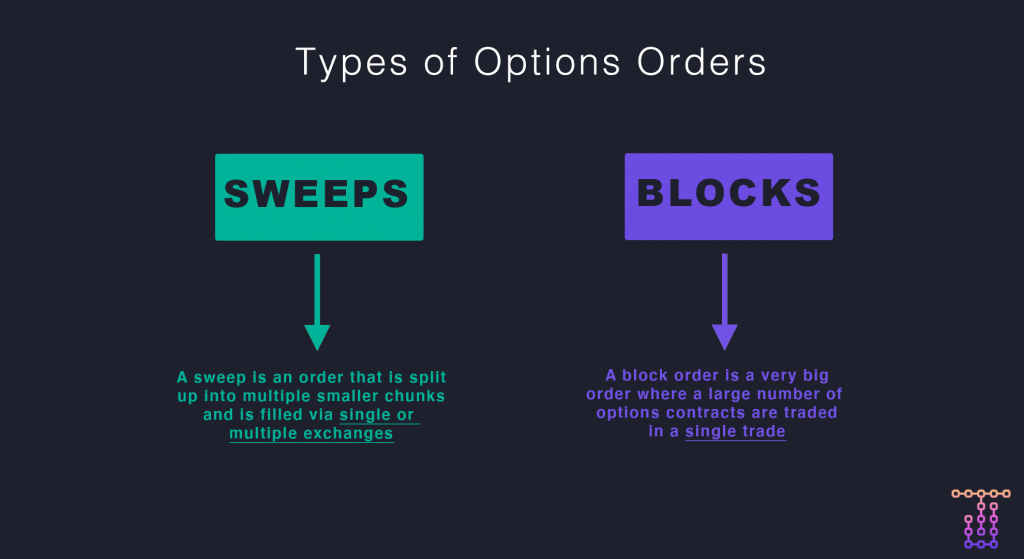

Understanding the Different Kinds of Orders

We want to provide a summary of the three different kinds of orders that are most common so you can have a better understanding of the tips we will provide later on. These options orders are called sweeps, splits, and blocks.

- Sweep Options Orders

When it comes to options orders, sweeps are the kind that is divided into smaller trades so they can be completed over a series of exchanges. Traders use this kind of order for many different reasons in trading.

For one, traders sometimes have additional information regarding a certain company that allows them to feel confident about what direction the price will take. However, they don’t want to advertise that knowledge, so they hide it using sweeps.

As mentioned earlier, sweeps get filed as several individual orders, so most people can’t see the big picture because they can’t see the larger activity going on.

Secondly, if traders want their order to be filed super quickly, they can use sweeps to leverage liquidity from several exchanges. Essentially, traders use sweeps when they either want to hide information or want to complete the trade very quickly.

For this reason, sweeps can be taken as a sign that someone has information others don’t, which is why they make the effort to either hide that or speed up their trade.

Example:

In this example, you can see how effective sweep orders are. On February 16, there were two sweeps made in the early morning hours for FUTU. At the moment, its price was around 170, but a sweep was made for a $200 strike. That’s higher.

So, what does this mean? It means that they are confident about a FUTU price increase coming soon. How can we assume that’s what’s going on? We just have to see the contract’s expiration date, which only had three days left on it.

Following the sweep, FUTU prices did go up by $20 in just a couple of hours. So, a contract that was previously traded for $6.45 is now being traded for $14.07 and this change occurred in a matter of hours.

Going back to the example presented above, the trader we see on the second row made a 100% profit in just a few hours. This is why sweeps are so powerful and how you can use them to find a flow that you can follow to increase your earnings.

- Split Options Orders

Splits are not very different from sweeps because they are also large orders that get divided into smaller orders. What sets them apart is the splits get filed on the same exchange.

Example:

As you can see here, we have three splits for CCIV made on February 16. The first split was made when the price for CCIV was $41 for a strike price of $50. That’s higher.

Wouldn’t you know it! 48 hours later, the price for CCIV went up and we can see another set of splits was made. At the end of the day, the price for CCIV was $52, which is an almost $10 increase in a matter of a few hours.

- Block Options Orders

Last but not least, large individual trades are considered blocks in live options flow. Usually, blocks are made by big institutions that either buy or sell a large chunk of contracts. To be specific, trades with a minimum of 5,000 volume are considered blocks.

Example:

In this example, you can see how powerful blocks can be. There was a block trade made in the early morning of February 16 and it was worth 1.32 million dollars and 8,488 volume for AMTX. In a matter of hours, the price increased to 9.25 from 8.5.

How to Find Effective Setups: 8 Useful Tips

It’s time to get into the useful tips that will allow you to use live options flow effectively now that you have a basic understanding of the kinds of orders and what they mean. Live options flow is a powerful tool and you have a lot to gain from learning how to take advantage of it, that’s why we want to provide a few pointers you can leverage.

One of the most important things you need to understand about analyzing live options flow is that it’s not a science, it’s more of an art form. That means it’s subjective and there are many more ways to interpret it than what we’re describing today. However, these tips will help you a lot, especially if you’re just getting the hang of this tool.

Our tips on how to use live options flow will help you on the path of learning to be a much better trader. This is only the beginning though and there’s a lot more to learn, so don’t lose your curiosity and keep researching once you’ve mastered the basics and given our tips a try. Without further ado, let’s get into it!

- Bursts Are Very Useful for Traders

Whenever you see a burst of options orders featuring large premiums, that’s a very useful pointer to keep in mind. What these bursts mean is that something is about to occur and people with insight about it are making moves before the prices move one way or the other. So, bursts are a very useful signal to keep an eye on.

- Trading Above the Ask Price Is a Show of Confidence

When options orders of whatever kind are being traded for more than the asking price, it means someone is feeling very confident and that’s a very strong signal to consider. If a trader is happy to pay higher than what’s being asked, it shows that they’re confident about the move they’re making because the information they have is reliable and very telling.

- Short Expiration Dates Signal Urgency

Whenever trades are made with short expiration dates, it’s not only a sign of confidence, it also means that they are in a rush to make a move because they know the price will change very quickly and they have to jump on the bandwagon before it’s too late.

- Sometimes It’s Better to Skip Spreads

More often than not, it’s very challenging to tell when a trade is a part of a strategy or when it’s part of a purchase or sale. The live options flow will provide data that will allow you to tell the difference between the two. For traders who are just getting started, it’s often a good choice to skip trades whenever they are a part of greater strategies. Why? Because it’s more difficult to deduce their signals.

- Pay Attention to Far OutStrikes

If you see that a large amount of money is invested in far-out strikers, you need to pay attention. Sometimes, when investors feel confident about a big move, they purchase far-out strikes because they cost less than other kinds of strikes.

- It Matters When Volume Is Greater Than Open Interest

Whenever you see that a trade has a greater volume than the open interest for the options contract, it could be a sign of confidence and urgency. When that happens, it is due to the lack of liquidity of small open interest. So, if the investor wants to trade even in those circumstances, it means they feel pretty strongly about what’s going on.

- Pay Attention to Implied Volatility

This tip may be a bit more difficult to grasp, but to put it simply, whenever implied volatility increases greatly, it’s better to avoid buying contracts for the stock in question. When IV goes up it’s due to a phenomenon called Mean Reversion, which occurs in financial markets, and it points to the fact that certain things eventually revert to their average position.

For example, if IV increases too much, the expectation is that it will soon return to its average value. So, if you purchase a contract because the IV is high, the value of that contract will go down when the IV decreases, which will put you at a loss.

- Be Careful With IV Crush

Usually, IV will increase before something big happens. As we just explained above, it’s always a good choice to stand back when IV increases. When IV suddenly decreases once the event passes, contract prices will drop along with it. This is known as IV crush and you need to be very careful with it. That’s why we wanted to make you aware of it because falling for it can put you at a loss.

As you can imagine, these are only a few of the most helpful and effective tips to use live options flow to catch beneficial setups and enhance your PNL. You can give the tool of live options flow a try whenever you want and take advantage of all the wonderful features it has to offer. This tool is meant to make your life as a retail trader a lot easier and allow you to stay ahead of the curb. If you’re looking for an edge, live options flow will help you find it so you can take on the big fish at Wall Street.

Final Words

We want to close today’s article by reiterating that the analysis of live options flow should be seen as an art and it’s a craft you must work on. We recommend you dedicate time to understanding historical patterns so you can build strategies that will work for you because that’s the most effective approach.

Live options flow provides access to a ton of information that you can use to your advantage and become better at trading, but you have to take the time to study it and understand it.

Today, we’ve given you the basics and provided many helpful tips so you can build on that knowledge and elevate your craft as a trader. Don’t hesitate to continue your education to reach your goals.

Get free trial https://Tradeui.com/FREETRIAL

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!