2 yr. ago

Gold is currently trading at $2,315, reflecting a decline of 0.17% in today’s session. The precious metal is maintaining its position above the key pivot point of $2,310.75, having completed a 23.6% Fibonacci retracement around this level. This suggests the potential for a bullish reversal.

Immediate resistance is identified at $2,310.75, with further resistance levels at $2,325.55, $2,337.19, and $2,348.85. On the downside, immediate support is found at $2,287.07, followed by $2,273.43 and $2,260.22.

Technical indicators provide additional context. The 50-day Exponential Moving Average (EMA) stands at $2,329.96, and the 200-day EMA is at $2,334.25. Both indicators suggest a slight bearish trend, given that the current price is below these averages. However, holding above the pivot point of $2,310.75 may indicate a short-term bullish outlook.

Immediate resistance is identified at $2,310.75, with further resistance levels at $2,325.55, $2,337.19, and $2,348.85. On the downside, immediate support is found at $2,287.07, followed by $2,273.43 and $2,260.22.

Technical indicators provide additional context. The 50-day Exponential Moving Average (EMA) stands at $2,329.96, and the 200-day EMA is at $2,334.25. Both indicators suggest a slight bearish trend, given that the current price is below these averages. However, holding above the pivot point of $2,310.75 may indicate a short-term bullish outlook.

2 yr. ago

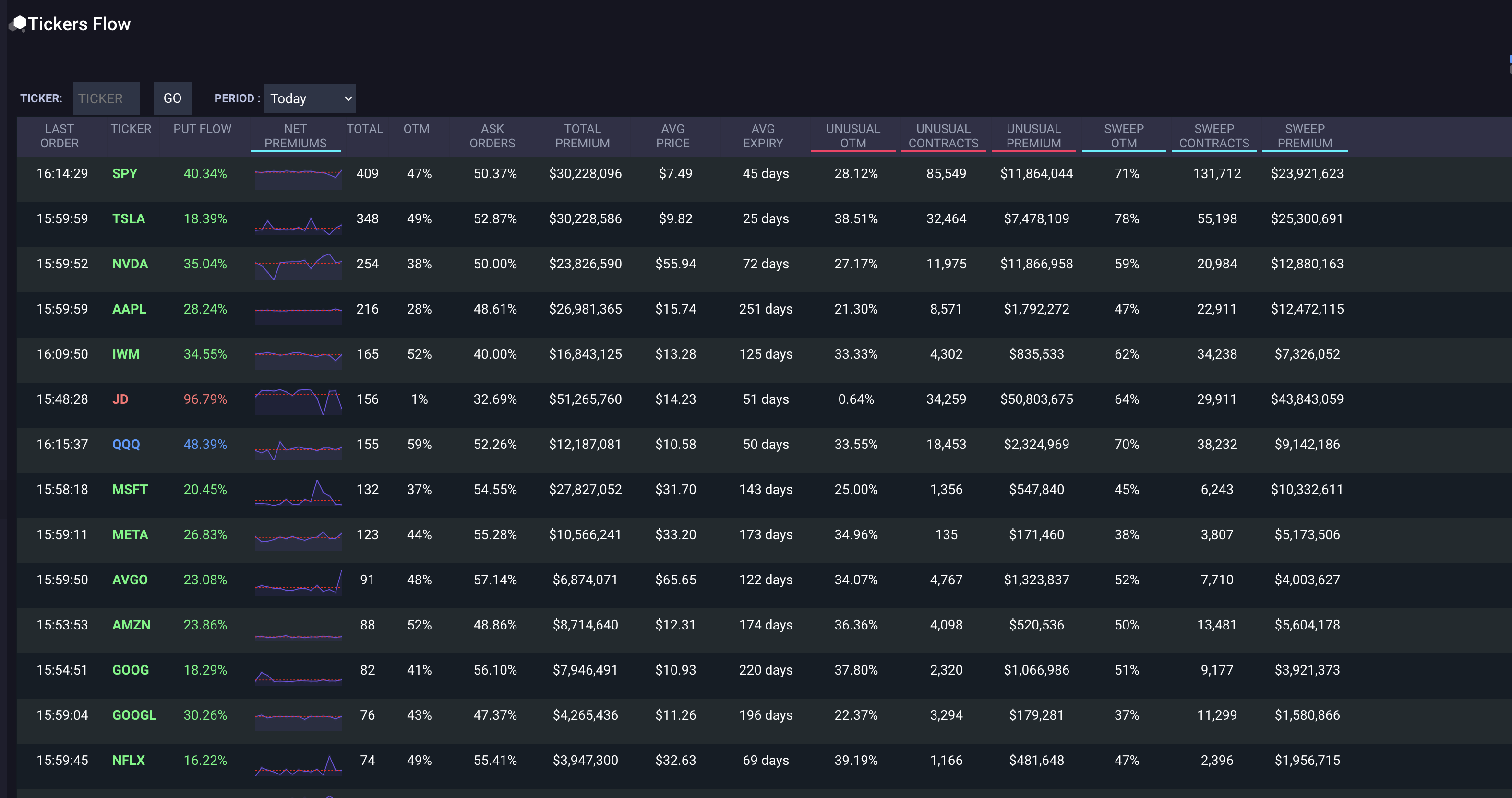

$AAPL Apple events tend to historically dump after hype and reality are a let-down, so could be a good scalp play for bearish tomorrow. Event is at 10AM est. Some bullish spread levels seem to want $185 so if we're at around that level by the time of its event I will be considering puts.

2 yr. ago

$DIS Nice bearish setup on 1y1d. Big rally right BEFORE earnings? Seems suspicious to me. Same weeks and next week options virtually same cost due to low volatility sooo, should be good to play either. No point in taking the extra decay risk when the prem prices are only about $20 to $30 more per contract. Thinking we see a retest of 110.