Top Flow Feature

Live option flow is an important tool for all traders, it shows you what smart/big money is betting on whether be it stocks or ETFs. Since contracts have an expiration date options/stock traders use the expiration date to get an idea on when the move is going to happen.

What is the Top Flow component?

This is a unique and very useful tool created by TradeUI to give you a quick glance on how the money is spent within your selected time period. If used during market hours it will show you where the money is spent for that specific day.

In many cases the top tickers listed under Top Flow would be moving in the direction indicated on the component. If the box is green it means the quantity of call orders is twice or more that of the puts and vice versa. Purple is in between “undecided”.

Top Flow has two modes:

1 Extended mode that shows NET PREMIUM (TOTAL CALLS PREMIUM – TOTAL PUTS PREMIUM)

Top Flow Extended

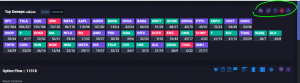

2 a compact mode shows total orders of CALLS/ total orders of PUTS seen on the screenshot below.

The 3 dots icon allows you to expand and see more results.

The menu is on the top right side and a button to sort by TOTAL CONTRACTS or TOTAL PREMIUM is located on the left side.

How to read the Top Flow?

When you see an overly bullish or bearish box, for example V on the second screenshot has 67 CALLS orders over 7 PUTS, or on the other hand CHWY has 4 CALLS over 53 PUTS, you want to take a look at the intraday and daily chart, find your support resistance levels and assess your risk. Also see if the stock/etf has any news bullish/bearish news before entering a trade.

TradeUI also provides you with an additional tool the Chain overview which gives you an idea on where all the volume and open interest is located.

We will be providing more articles and videos to show you strategies to better utilize the tool this is a how to.

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!

Elevate your trading game with TradeUI Pro! Enjoy 2 Months when you go yearly!